Cap rate equation

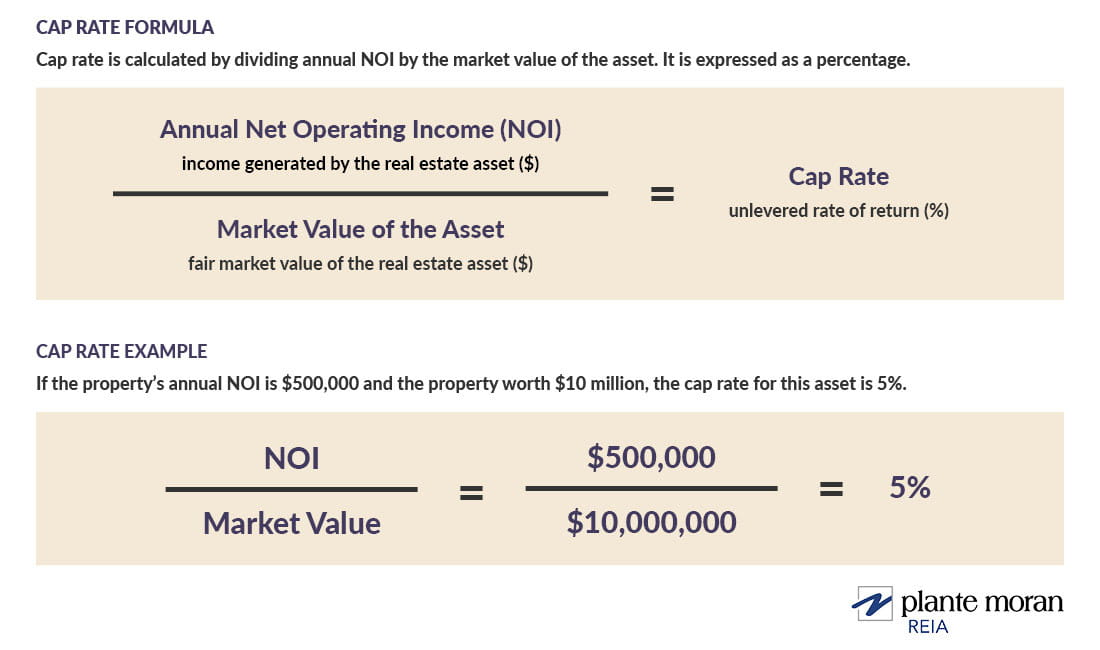

The cap rate formula is. The NOI tells an investor how much money they can expect to make from a rental property at a.

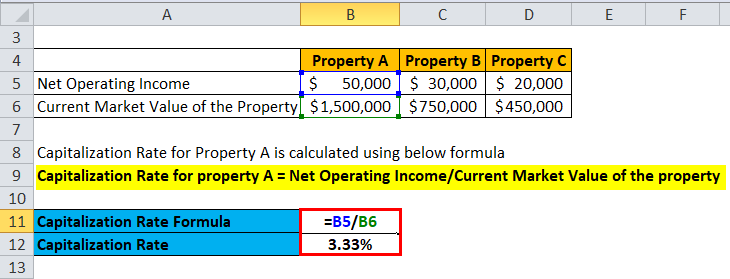

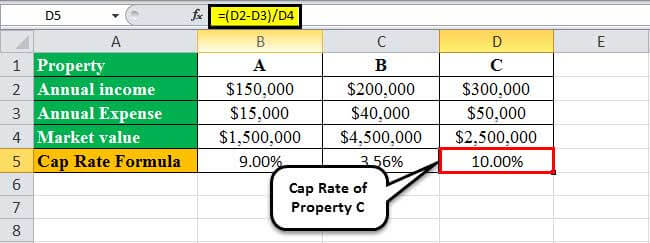

Market Capitalization Formula Calculator Excel Template

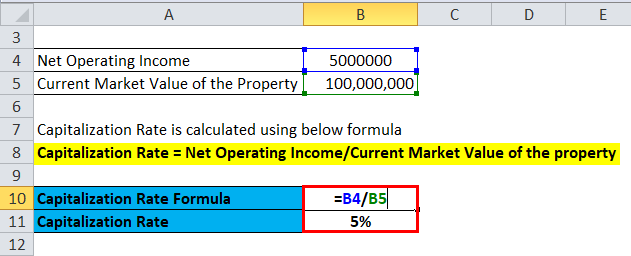

The Cap Rate Formula divides the Net Operating Income NOI of a property by the current market value of the property.

. Gross income expenses net income Divide net income by purchase price Move the. The cap rate is calculated as 12 minus 3 or 9. EqtextCapitalization Rate frac15200160000 eq eqtextCapitalization Rate.

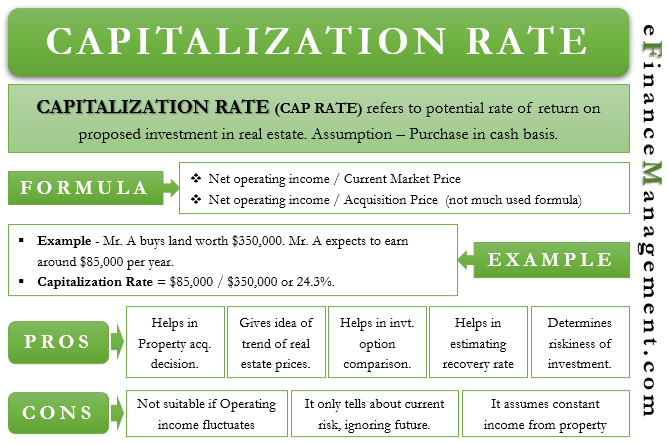

LTV debt ratio x mortgage constant LTV equity ratio x equity constant derived cap rate To finish the example using the mortgage terms given above and the desired 20 cash on cash. It refers to the return rate on an investment of a real estate property. Formula Net operating incomeAssets current market value read more we can calculate the capitalization rate of the building is.

Before we explore some examples lets discuss the two inputs. First we talked about how to calculate the. Cap Rate Formula Net Operating Income Property.

1000000075000000 1333 Thus if the building is. Cap Rate Net Operating Income NOI Total Purchase Price. Cap Rate NOI Property Value NOI Property Value x Cap Rate 150000 Property Price x 72 Cap Rate 10800 NOI Now that you know that the realistic NOI for the property is 10800.

For example if a property valued at 1 million is expected to receive rent. How Do You Calculate a Cap Rate. Lets say your comparable sold for 250000.

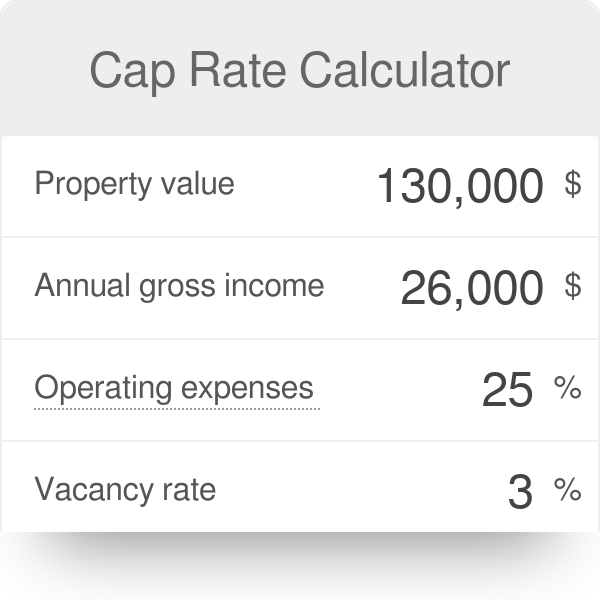

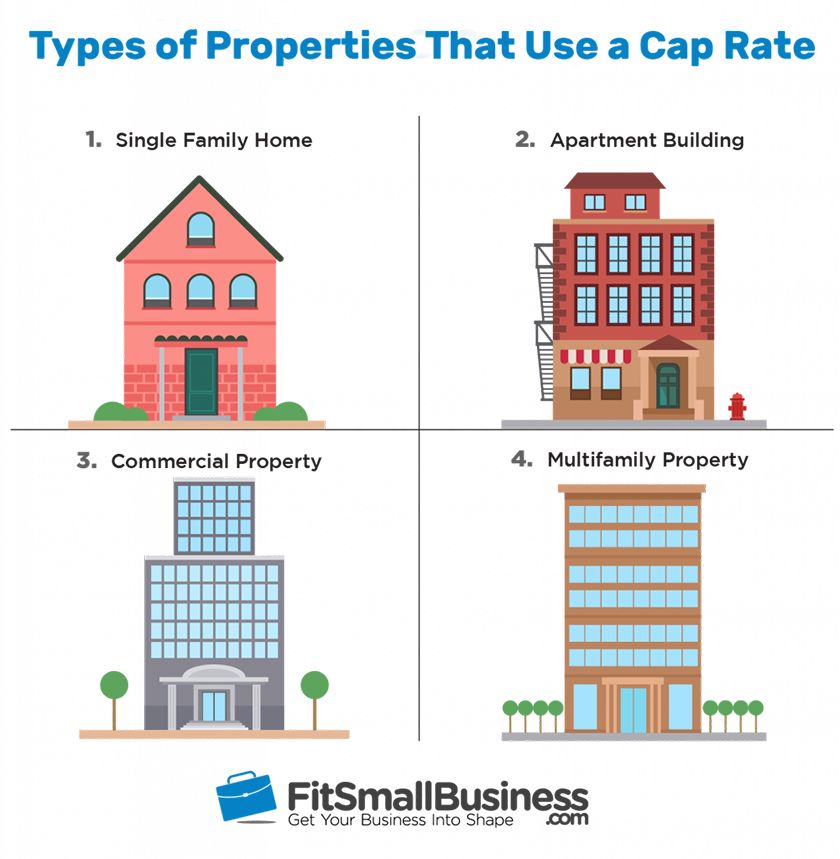

91 40000 X X. How to Calculate the Cap Rate. Its based on the income you expect the property to generate.

The outcome of this calculation following the capitalization rate formula is. Divide that by the 250000 sales price. The net operating income NOI is the propertys annual income minus any expenses incurred.

To calculate cap rates use the following formula. Youve determined that the propertys NOI after deducting applicable expenses is 50000. Cap Rate NOI Current Property Value.

Assuming that the average cap rate for comparable properties is 91 we can attempt to find out whether the asking price is justified for this property. This is a measurement thats used to estimate the potential. Conclusion In this article we discussed several ways to calculate the cap rate.

What You Should Know About The Cap Rate Propertymetrics

Cap Rate Formula Step By Step Cap Rate Calculation

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Buying Investment Property

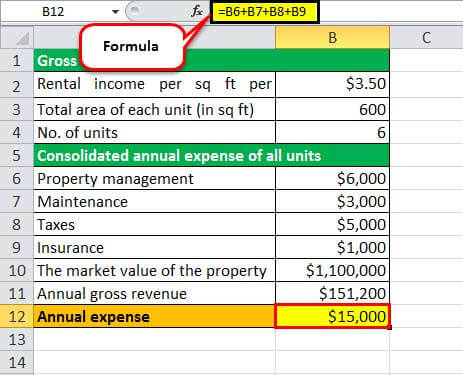

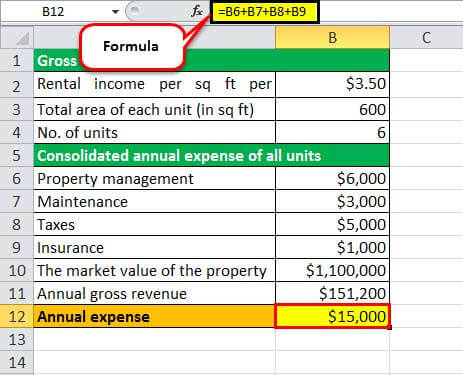

Capitalization Rate Formula Calculator Excel Template

Capitalization Rate Formula Calculator Excel Template

Return Metrics Explained What Is A Cap Rate In Commercial Real Estate Our Insights Plante Moran

Capitalization Rate Formula Calculator Excel Template

Cap Rate Calculator Propertymetrics

Easy Cap Rate Calculator Rentspree Blog

Cap Rate Follies Ccim Institute

Como Calcular La Tasa De Capitalizacion 6 Pasos

Cap Rate Calculator Propertymetrics

Cap Rate Calculator

Cap Rate Formula Step By Step Cap Rate Calculation

Capitalization Rate Meaning Formula Examples And More

Capitalization Rate Formula What A Good Cap Rate Is

Cap Rate Formula Step By Step Cap Rate Calculation